The solar power sector is, without a doubt, one of the most booming industries not only in India but also throughout the world.

Recent Developments in the Solar Industry

According to a report, the months of April to June saw the sector’s ability to draw an overall funding of more than 24,000 crore rupees through means of 66 deals, together with two Indian deals – Azure Power and Reliance Power.

Taking into account the funding provided by the Mercom Capital Group in the second quarter and the M&A activity details related to the solar sector, worldwide investment capital funding witnessed a minor uptick with a total of 32 deals coming to 376 million USD, even in challenging solar market. The funding analysis stated on the report was carried out on the basis of four groups viz. debt funding, VC funding, project funding and others.

The project funding group consisted of two Indian transactions. The first involved Reliance Power securing a loan from the ADB or Asian Development Bank for an amount of 103 million USD. Azure Power’s ability to secure a loan of $70.4 million from the Export Import Bank of the United States in long-term financing was second in the report. Reliance Power had sought the loan from ADB because of its 100 MW CSP venture while Azure Power was promised financing in lieu of increasing its 5 MW solar PV undertaking to 40 MW.

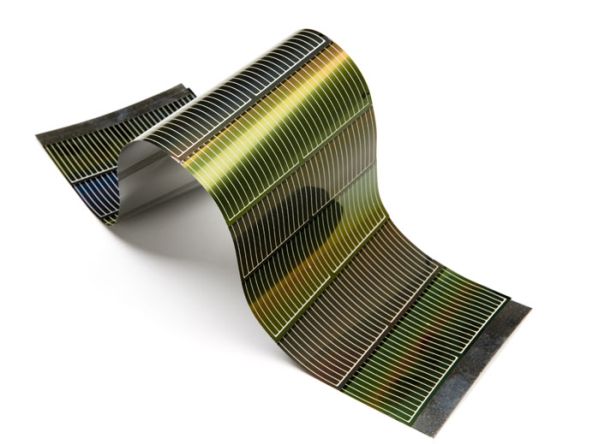

It seems that in case of VC funding deals, downstream firms got the best options with USD 133 million spread out across nine different contracts, followed closely by thin film corporations which were benefitted with USD 121 million divided amongst four deals this quarter. Even though BOS or balance-of-system companies form a considerable opportunity for venture, improvement and expense reduction, they are now the greatest part of the solar sector. However, VC ventures in BOS have remained consistently low.

Solar companies have now been forced to downsize or go out of business almost every other day. But the good news comes in the form of ongoing steady VC venture activity in the division.

M&A operations in the solar sector came to a total of 325 million USD through 14 dealings. Details have been made known about only six of these dealings. The best M&A transactions seems to have been the possession of Chinese mono and polycrystalline developer, Zhejiang Topoint Photovoltaic by Guangxi Beisheng Pharmaceutical for USD 276 million in asset restructuring scheme. Most of the M&A activity seem to have revolved around weak companies disposing of assets and non-strategic businesses.

The second quarter of this year also witnessed new cleantech and solar-attentive investment funds, 13 in number, proclaiming their commitment of USD 3.2 billion.

Gujarat Power Project

The Gujarat state government has understood the potential of renewable energy and is considering the likelihood of establishing a 1,000 MW solar energy program. The government has started discussions with the IFC or International Finance Corporation, which is a division of World Bank, to request its assistance for the project. The project remains in the conceptual level at the moment but will commence as soon as IFC provides their response.

The projected is expected to cost something between Rs. 8,000 to 9,000 crores. The sheer magnitude of the project can be realized by considering the overall solar power production volume in the country which stands at almost 1,000 MW at present and comparing it to the 600 MW in the state of Gujarat alone. The IFC seems eager to provide its support to this kind of an undertaking.

On the nationwide level, Mahindra and Mahindra, the varied business multinational has announced its plans to establish solar power projects in the country producing 100 MW within a span of 2 to 3 years time.